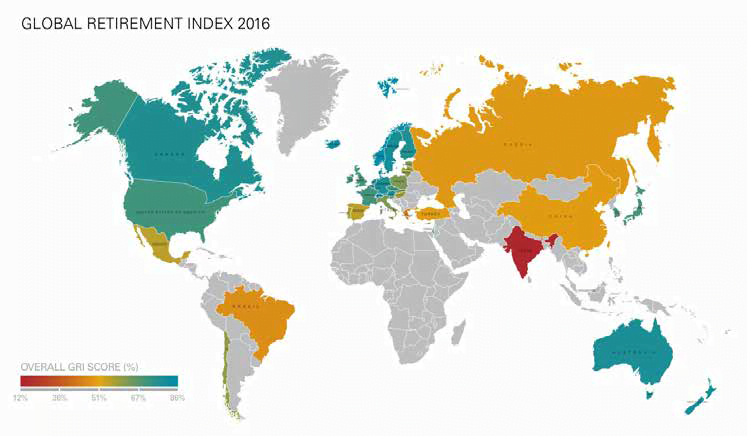

The Global retirement index of 2016 was published on July 20th by Natixis Global Asset Management. It takes into account key factors affecting retirement security and is instrumental in comparing best practices regarding public and retirement policies across 43 countries.

2016 Global retirement index : Northern European countries rank the highest

Northern European countries are at the top of the index : Norway ranks first, followed by Switzerland, Iceland, Sweden, Germany, the Netherlands and Austria. Non-European countries also feature in the top ten countries : New-Zealand (4th), Australia (6th), and Canada (10th).

Retirement systems must change to adapt to new realities

“Retirement was once a simple proposition: individuals worked a lifetime and saved, employers provided a pension, and payroll taxes funded government benefits. The end result was a predictable income stream, generated from three stable sources that could provide a financially secure retirement”, Natixis Global Asset Management President and Chief Executive Officer John Hailer said. “But demographics and economics have rendered old models unsustainable. In response to surging populations and expanding lifespans, employers continue to shift the responsibility of retirement funding to the individual, and policy makers are challenged to respond.”

What is Natixis Global Asset Management’s global retirement index ?

Natixis Global Asset Management’s global retirement index was created in 2013 ; compared countries are all assigned a mark reflecting retirement security, on the basis of four factors impacting retired life.

Although retirement funding is paramount, the index also considers other factors such as material well-being, health and life quality of retirees in order to give a comprehensive view of retirement. This year’s investigation examined a lesser number of countries, mainly developed countries where social and economic stakes are high where retirement is concerned.

This investigation deals with members of the OECD deemed economically-developed by the IMF’s standards, as well as BRICS. The figures indicated below stem from various sources, one of which is the World Bank. Researchers calculated the average mark for each of the 43 countries examined in each category, then combined thusly obtained marks in order to assign an overall mark used to determine the country’s position in the rankings.

France did well in terms of healthcare system and life expectancy, but financial factors point to some difficult times ahead

France fell from 18th last year down to 20th this time around. This decline is mainly due to the change of scope of the investigation, which only deals with developed countries and gives more weight to financial considerations in the final mark.

The French Healthcare system is one positive : social security is very much in favour of retirees and France remains among the Top 10 countries in terms of life expectancy.

The issue of retirement funding in general and tax burden in particular drags the country’s overall mark down. On a positive note, tax burden and unemployment factors are not felt quite as keenly as last year. The French government seems ready to address the structural issues of unemployment and government debt, meaning that France has the potential to get out of the ditch.

French productivity is also one of the highest in the world. The job market’s reform could drive companies to create jobs, while the French working population will grow to be the biggest among Eurozone countries.

“Today, France’s biggest challenge is to manage finances without putting too much strain on the public services which benefit retirees“, Christophe Point, Managing Director of Natixis Global AM Distribution for France, French-speaking Switzerland and Monaco.

“In top-ranking countries, innovative policies have been a key factor in sustaining retirement systems. Those countries attach great importance to the wellbeing of retirees, and have implemented schemes and attractive fiscal practices, as well as awareness-raising programmes aimed at promoting preparation among future retirees. Those are interestig initiatives when you stop to consider that 70% of French private investors (77% worldwide) report being aware that they will have to self-fund a greater part of their retirement.“

Managing retirement : four prevalent world trends

Decision makers and employers could learn a lesson from the four milestones shared by several highest-ranking countries with regard to ensuring retirement sustainability :

- Access : the ageing of working-age population and a greater life expectancy in several Western countries have rendered traditional pay-as-you-go state pension funding strategies less efficient. Private individuals will now have to shoulder a greater part of retirement funding, driving decision-makers in charge of dedicated public policies to make sure that workers gain access to adequate saving options in the countries that scored the highest.

- Incentives : “smart” or proactive policies implement short-term incentives to try and get workers to save more to help them fund their retirement. Implementing a tax system that favours retirement savings allows workers to put more money in the bank.

- Involvement : getting employees to participate in funding their company’s additional retirement fund is a step in the right direction. Adequate policies also ensure that workers’ investments are relevant and that they have enough information to go around in order to reap the full benefits of their investments.

- Economically : savings vehicles aren’t all there is to retirement security. Health, monetary and fiscal policies all contribute to making sure that retirees will be able to support themselves.

« Individuals may have to assume greater responsibility for their retirement funding; nevertheless this should also be the responsibility of policy makers, employers and the investment industry – altogether – to ensure workers have the tools and incentives they need to save and better plan for their retirement” », Christophe Point explains.

“Achieving retirement security is a daunting goal, but it is within reach if each stakeholder does their part“, he concluded.

Download the Global Retirement Index Report

Published by the Editorial Staff on